Understanding Beta Coefficients

Master the fundamentals of beta and learn how this crucial metric reveals an asset's market sensitivity through step-by-step calculations.

SharpeTracker Team

October 2, 2025

What is Beta?

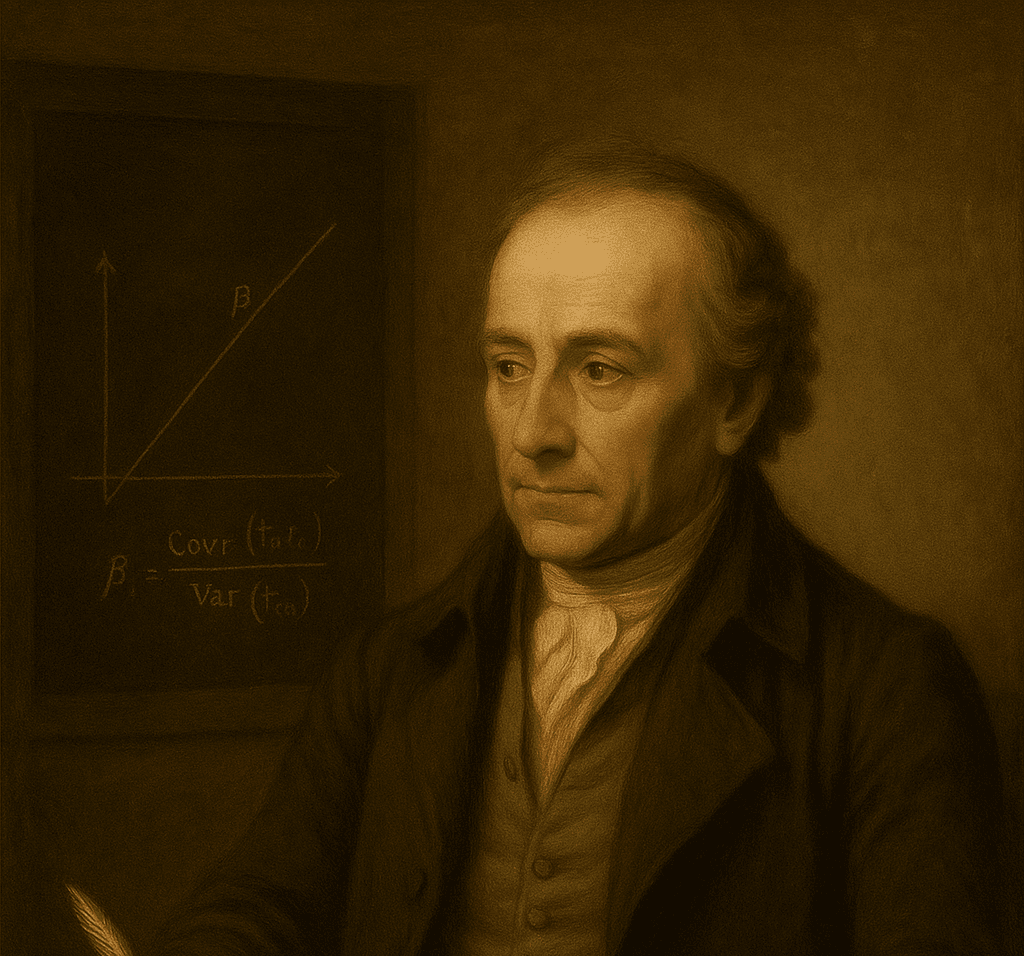

Beta measures an asset's volatility relative to the overall market. It quantifies systematic risk—the risk that cannot be eliminated through diversification. A stock with β = 1.5 is 50% more volatile than the market, while β = 0.8 indicates 20% less volatility.

Beta Formula

Where Rₐ = asset returns and Rₘ = market returns

Step-by-Step Calculation

Let's calculate beta for Stock XYZ using 5 months of data:

| Month | Stock XYZ | Market (S&P 500) |

|---|---|---|

| 1 | 8% | 5% |

| 2 | -4% | -2% |

| 3 | 12% | 7% |

| 4 | 6% | 4% |

| 5 | 3% | 1% |

Step 1: Calculate Average Returns

Average Stock Return = (8 - 4 + 12 + 6 + 3) / 5 = 5%

Average Market Return = (5 - 2 + 7 + 4 + 1) / 5 = 3%

Step 2: Calculate Variance of Market Returns

Var(Rₘ) = Σ(Rₘ - R̄ₘ)² / n

= [(5-3)² + (-2-3)² + (7-3)² + (4-3)² + (1-3)²] / 5

= [4 + 25 + 16 + 1 + 4] / 5

= 10

Step 3: Calculate Covariance

Cov(Rₐ,Rₘ) = Σ[(Rₐ - R̄ₐ)(Rₘ - R̄ₘ)] / n

= [(8-5)(5-3) + (-4-5)(-2-3) + (12-5)(7-3) + (6-5)(4-3) + (3-5)(1-3)] / 5

= [6 + 45 + 28 + 1 + 4] / 5

= 16.8

Step 4: Calculate Beta

β = Cov(Rₐ,Rₘ) / Var(Rₘ)

β = 16.8 / 10

β = 1.68

Interpreting the Result

Stock XYZ has a beta of 1.68, meaning it's 68% more volatile than the market. If the market rises 10%, we expect XYZ to rise approximately 16.8%. This makes it an aggressive stock suitable for growth-oriented portfolios but with higher risk during downturns.

Quick Reference

- β = 1.0: Moves with market

- β > 1.0: More volatile (aggressive)

- β < 1.0: Less volatile (defensive)

- β ≈ 0: Independent of market

Using Beta in Portfolio Management

SharpeTracker automatically calculates beta for your holdings, helping you balance high-beta growth stocks with low-beta defensive assets. Understanding each position's beta allows you to construct portfolios aligned with your risk tolerance and market outlook.